Are you facing financial hardship and worried about your student loan payments? You're not alone. Many borrowers find themselves in situations where they need a temporary reprieve from repayment. Luckily, there are several options available known as deferment. This allows you to postpone your payments for a set period without accruing interest. Understanding the diverse types of deferment and their requirements is crucial to making the best decision for your individual circumstances.

- One common type of deferment is in-school deferment, which applies when you're enrolled at least full-time in an eligible program.

- Furthermore, unemployment deferment provides relief if you've lost your job and are actively seeking new employment.

- For those serving in the military, there are designated deferment programs available to ensure their financial well-being.

It's important to note that deferment is not forgiveness. You will still need to repay the full loan amount once the deferment period ends. By meticulously considering your options and contacting your loan servicer, you can find the best path for managing your student loans during challenging times.

Exploring Your Student Loans

Managing student loan debt can feel overwhelming, however there are resources available to guide you navigate this difficult financial landscape. First, carefully review your debt documents to understand the terms. Explore various repayment strategies, considering factors like salary and expenses. Don't avoid to reach out your loan servicer if you have questions.

- Consider income-driven repayment plans, which adjust your monthly payments based on your earnings.

- Research loan remission programs, if you qualify.

- Consider refinancing options to potentially decrease your interest rate.

By adopting a strategic approach, you can effectively manage your student loan debt and strive towards financial stability.

Strategies for Negotiating Student Loan Terms

Navigating educational loan repayments can feel overwhelming. Fortunately, there are effective strategies you can utilize to obtain more favorable terms. One key strategy is completely understanding your loan details. This includes identifying the lender, interest rate, repayment plan, and any present deferment or forbearance options. Equipped this knowledge empowers you to engage with your lender assuredly.

Next, explore potential discussion opportunities. Some lenders might be willing to reduce your interest rate, extend your repayment period, or offer a temporary challenge plan if you reveal financial difficulties. Always record all communication with your lender, including letters, to generate a clear account of your exchanges.

- Bear in mind that lenders are usually willing to {work{ with borrowers who interact proactively.

- {Furthermore|Additionally|, prepare for negotiations by gathering any relevant monetary documentation, such as pay stubs, tax returns, and outline statements.

Unlocking Deferment Eligibility for Student Loans

Navigating the complex world terrain of student loan repayment can be overwhelming. One strategy to ease the burden is through deferment, a brief postponement of payments under certain circumstances. Determining your eligibility for deferment requires a detailed understanding of the conditions set forth by your loan servicer and the federal government.

Start by recognizing your current economic situation. Several factors can make you eligible to deferment, including registration in school at least half-time, unemployment, or contributing in a military service.

Once you have identified your suitable circumstances, accumulate the essential documentation to validate your application. This may encompass proof of attendance, lack of work verification, or military service records.

Submitting a comprehensive and accurate deferment petition to your loan servicer is the next crucial stage. Be sure to scrutinize their procedures carefully, as each circumstance may have specific requirements.

Grasping your options and acting diligently can help you obtain the deferment relief you need to manage your student loan debt effectively.

Understanding Student Loan Deferment: A Comprehensive Guide

Facing financial challenges? Managing Menopause Weight Gain Consider the potential of student loan postponement. This powerful tool can offer temporary relief from payments when you're experiencing financial stress. A comprehensive understanding of deferment eligibility, application processes, and potential implications is crucial. This guide delves into the intricacies of student loan deferment, empowering you to make informed decisions about your educational future.

- Uncover the various reasons that qualify you for deferment.

- Familiarize yourself with the application process and required documentation.

- Analyze the potential effect of deferment on your overall loan repayment schedule.

Exploring Financial Hardship and Student Loan Relief

The weight financial hardship can be particularly crushing for students navigating the challenges of higher education. Many of students face significant obligations after graduation, often leaving them facing to stay afloat. This existence of student loan debt has sparked widespread concern about its impact on individuals and the market as a whole. Numerous solutions have been proposed to address this problem, including interest rate subsidies.

These initiatives aim to provide support to borrowers and make the process of settling student loans less burdensome. The persistent debate about student loan relief highlights the need for comprehensive solutions that address the root reasons of this increasing problem.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Mara Wilson Then & Now!

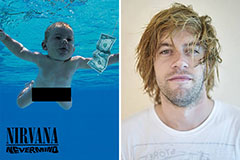

Mara Wilson Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!